Having control over one’s finances can prevent a lot of stress and create a more peaceful life. It is also easier to enjoy your life, connect with others and the world in general if you can do that from a financially abundant place.

The F.I.R.E movement focuses on how people can work towards Financial Independence so they can Retire Early or simply spend the time of their life in the way that they prefer instead of being locked into certain systems that might force them to use their life energy in a way they do not prefer.

F.I.R.E. is an interesting way to approach life, time, money and abundance.

To start first a video summary of the book: Your Money or Your Life. This book is often seen as the bible of the F.I.R.E movement and teaches people to start thinking in the amount of life energy you spend on something instead of just money. This can greatly clarify one’s motivations and priorities.

In addition there are certain steps that F.I.R.E. follows to work towards financial freedom. Here are the basic concepts and framework:

Step 1: Start tracking your income and expenses and make an oversight.

First get an oversight of what you spend and what comes in. A simple excel sheet will do, there are good apps for this also, you can even do it on paper, but simply learning about your income and expenses and tracking them gives oversight and is the basis for the next steps. Make sure you find out what your monthly and yearly expenses are preferably over at least the last 3 to 5 years.

Step 2: Calculate your yearly expenses, and get your F.I.R.E number from that.

Find out what you generally spend in a year. Find the number that you would feel is a good number to spend each year and would let you live a rich life that you enjoy. Now the goal is to save 25 years of those yearly expenses. Then if you can get a 4% interest over your savings, you have 100% of your yearly costs covered by passive income from your savings. (25 years times 4% = 100%)

So if you spend 20.000 euro a year your F.I.R.E.number is 500.000 euro (20.000 x 25). If you get 4% interest on 500.000 euro you get 20.000 of passive income each year from it.

Now if your yearly costs are 50.000 euro your F.I.R.E. number is 1.250.000 Euro.

If your yearly expenses are 80.000 euros your F.I.R.E. number is 2.000.000 Euro.

And from here you can do your own calculation for your number.

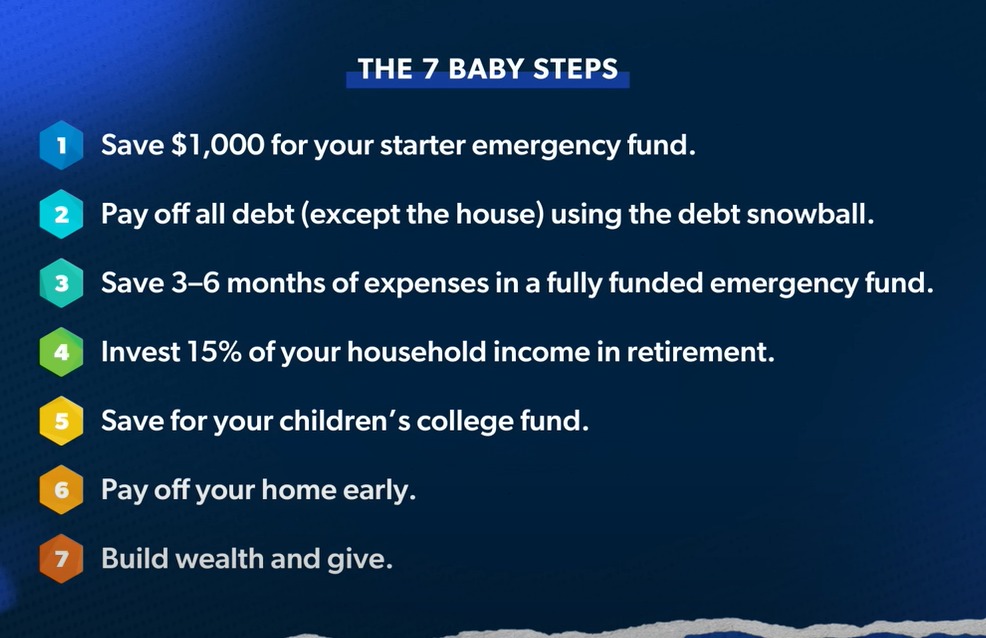

Step 3: Start saving and pay down high interest debt.

Now that you know your expenses and have set a target it is important that you start saving money every month. The easiest way to do is to start living below your means. How to use the money you save? If you have any high interest debt than pay it down as soon as possible. You are paying extra money to be in debt so someone else is getting rich from loaning you money.

Step 4: Save up 1 month of expenses, then 3 months then 6 months.

Once you paid off all high interest debt. Consider paying down low interest debt also and/or start saving money to cover at least one month of normal expenses so you build some financial safety. Once you hit one month, save up to three months and then make it six months. This creates a safety buffer so you won’t need to get into debt again if you encounter some minor and/or middle sized financial setbacks.

Step 5: Start investing to generate passive income over your savings.

Once you have saved up 6 months of expenses it is a smart move to invest additional savings so you can start building a passive income stream.

Read books, listen to podcasts, connect to other F.I.R.E. people in your area to learn about how and where to invest. Some people buy real estate to rent out to get an income. Others put it in index funds, others buy bitcoin, silver and/or gold.

This is the stage where you learn about assets and liabilities, be patient, be curious and open yourself up to learn about investing and find out what suits you.

Step 6: Save up and invest 25 years of expenses and generate 4% interest on your investment.

Repeat and continue with step 5 until you have 25 years of expenses invested and if you generate 4% interest on your investments on a yearly base you have then reached your F.I.R.E. goal. Every year you make as much money in passive income as your yearly expenses. You don’t need to work any longer to sustain your lifestyle. Congratulations on being F.I.R.E. Now you can start spending your life energy more and more in a way that you prefer and that feel meaningful to you.

Having a basic layout of how to become Financially Independent so you can Retire Early can give great stability and security to your financial situation.

F.I.R.E. provides this layout and it has great information sources and a community to connect to, to get inspiration from and share experiences with.

So look around, read books, listen to podcasts, watch YouTube, read mister money mustache his blog, connect to fellow F.I.R.E. interested people on social media, tell friends and family about it and maybe they want to join you on your F.I.R.E. journey so you both can retire early and learn from each other on the road to more financial freedom.

F.I.R.E. resources:

-) Mr. Money Mustache Blog

-) The Shockingly Simple Math Behind Early Retirement

-) Choose Financial Independence Podcast

-) Financial Independence 101 – Free training course designed to guide you to FI

-) YouTube Channel: Our Rich Journey

-) YouTube’s Channels: Ramsey Everyday Millionaire & The Ramsey Show Highlights

-) Reddit Community Financial Independence

Related articles:

-) Have a look at our (free) Arcturian Academy

-) Aligning with Natural Law to optimize Freedom

-) Compassionate Communication with Thoughts, Feelings and Needs (NVC)

-) The Power of 8 – Creating a harmonious group energy field

Early Retirement in One Lesson by Mr. Money Mustache (or How I Retired at 30)

Why You Should Focus On Paying Down The Mortgage Over Investing